By: Tim Rosinko Paul Cho

By: Paul Cho and Tim Rosinko

The Situation

March 21, 2023 — One of the most significant challenges for the auto market as a result of the COVID-19 pandemic was the steep decline in miles driven and the subsequent decline in auto claims — forcing the auto industry to reduce staff and sell off assets (e.g., rental cars) to lower costs. Many in the auto market took this opportunity to retire or leave the industry entirely, resulting in what many of our auto partners estimated was a more than 20% decrease in the auto-appraiser and auto-repair workforce.

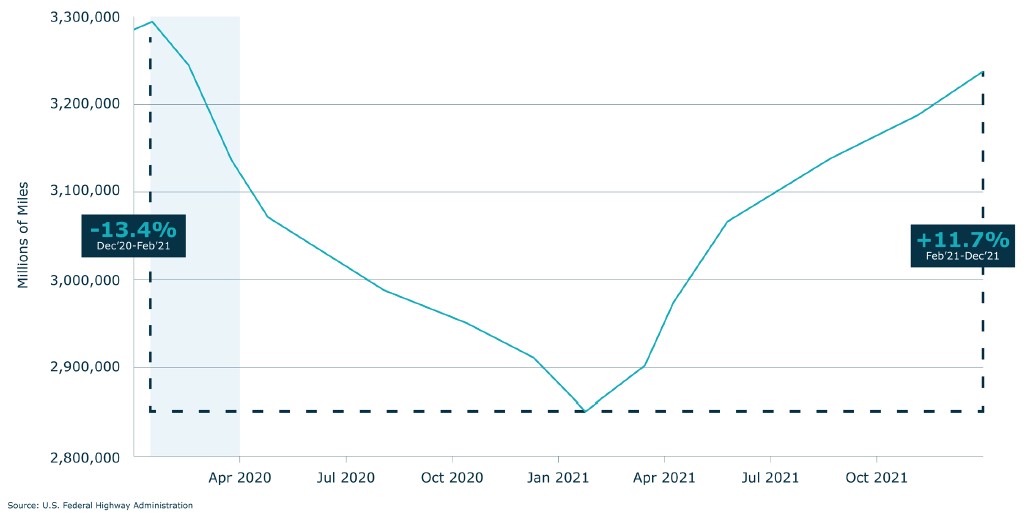

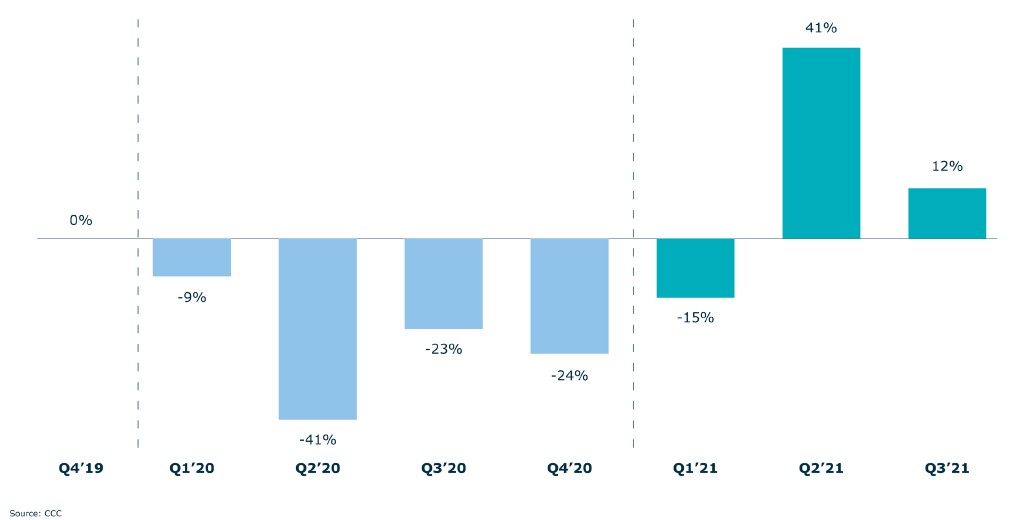

However, the rapid decline was followed by a dramatic uptick in miles driven (Figure 1), which drove auto claims and subsequent appraisals back up (Figure 2).

Figure 1: Miles Driven (U.S. Trailing 12 Months, Millions of Miles)

Figure 2: % Change in # of Appraisals/Valuations From Prior Year (Collision & Liability)

The Challenge

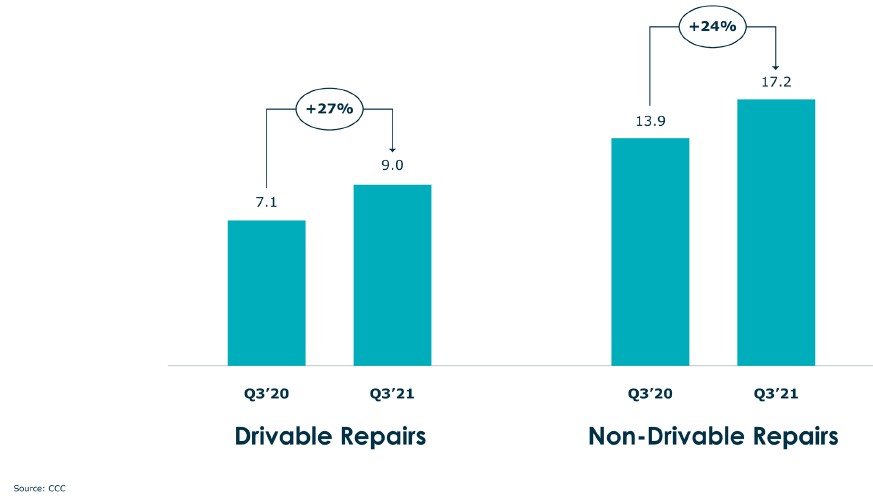

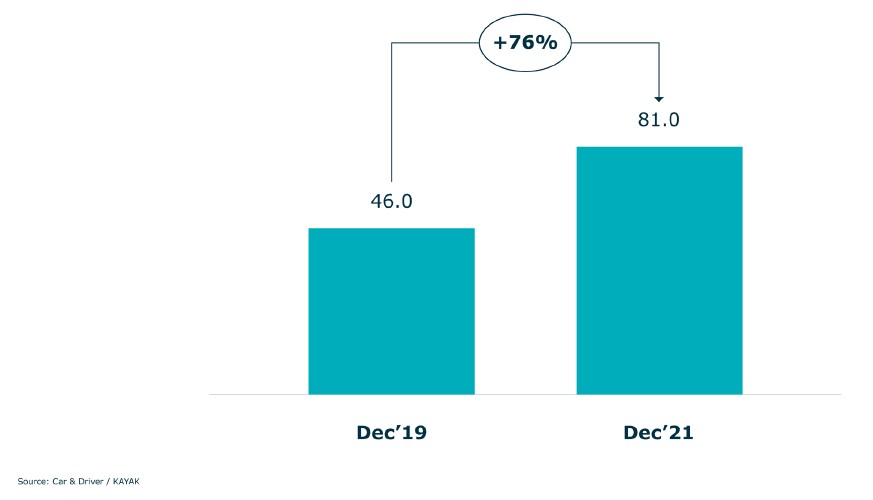

The unexpected and sudden recovery of motor travel and the corresponding rapid increase in claims caught the industry off guard. The industry was unable to bring on necessary staff and assets required for renewed demand. This unprecedented decline, subsequent reduction in resources and assets, and rapid recovery resulted in deteriorating service levels in the form of longer cycle times (Figure 3), as well as surging costs (Figure 4), negatively impacting claims organizations.

Figure 3: Average Repair Cycle Time (Days)

Figure 4: Average Retail Rental Car Cost per Day ($)

How GB Proactively Mitigates the Impact of Industry Uncertainty

GB consistently monitors industry trends and activities. As GB saw current industry challenges come to bear, GB was proactive and reinforced a number of initiatives to mitigate impacts from ongoing auto-industry issues.

First, GB partnered with leading organizations that have the most robust industry capabilities. Our partners prioritize GB, putting in place GB-specific processes, to ensure work is handled on a first-priority basis for all GB clients, leading to enhanced service levels (e.g., cycle times) and top quality, given inherent issues of "rushed" activity due to labor and asset shortages. In addition, our partners are actively hiring and training new people with a priority on locations where GB has the greatest need.

Second, GB continues to optimize their method-of-inspection process to ensure leading service levels, quality, and costs. GB's DRP/auto network is prioritized given the overall cycle time and cost value provided. With the current industry issues, photo and desk estimates have been further emphasized where appropriate (e.g., minor damage). As a result, reliance on field appraisals continues to decline, further mitigating impacts of industry labor issues and now rising gas prices. Third, GB has stringent partner price protections to ensure our clients receive the most competitive prices regardless of market situation. GB agreements have ensured pre-pandemic, industry-leading prices, even while the supply/demand issues have substantially increased costs and prices throughout the industry.

Market Outlook

On a positive note, since mid-February 2022, we have seen conditions change, with labor markets opening up, impact to service levels improving, and cycle times declining appropriately. GB actively monitors the evolving market in real time and provides proactive solutions to clients to mitigate negative impacts and take advantage of positive market situations. We are hopeful these positive trends will continue; however, if the market turns again, rest assured you will always receive the quality service and value expected from GB to help you achieve superior outcomes.

Authors

Paul Cho

Tim Rosinko

Make Gallagher Bassett your dependable partner

When making the right decision at the right time is critical to minimize risk for your business, count on Gallagher Bassett's extensive experience and global network to deliver.