March 22, 2023 — At the core of any well-managed loss program is effective collaboration between all stakeholders. Claim reviews are one of the key interactions that bring all parties together to review the client's book of claims and the trajectory of each claim file. Claim reviews can heighten focus on cost driver claims, unearth insights about the root causes of losses, and attain alignment on strategic approaches to accelerate claim resolution. That said, reviews often require a significant time investment without measurable benefit when a clear objective and targeted approach are not applied.

Gallagher Bassett's (GB's) client service managers and resolution managers spend roughly 300,000 hours annually preparing for and participating in claim reviews, which equates to approximately 8-12% of each individual's overall time.

GB is collaborating with clients and brokers, strategically aligning claim review file selection with program objectives to materially improve outcomes and client experiences.

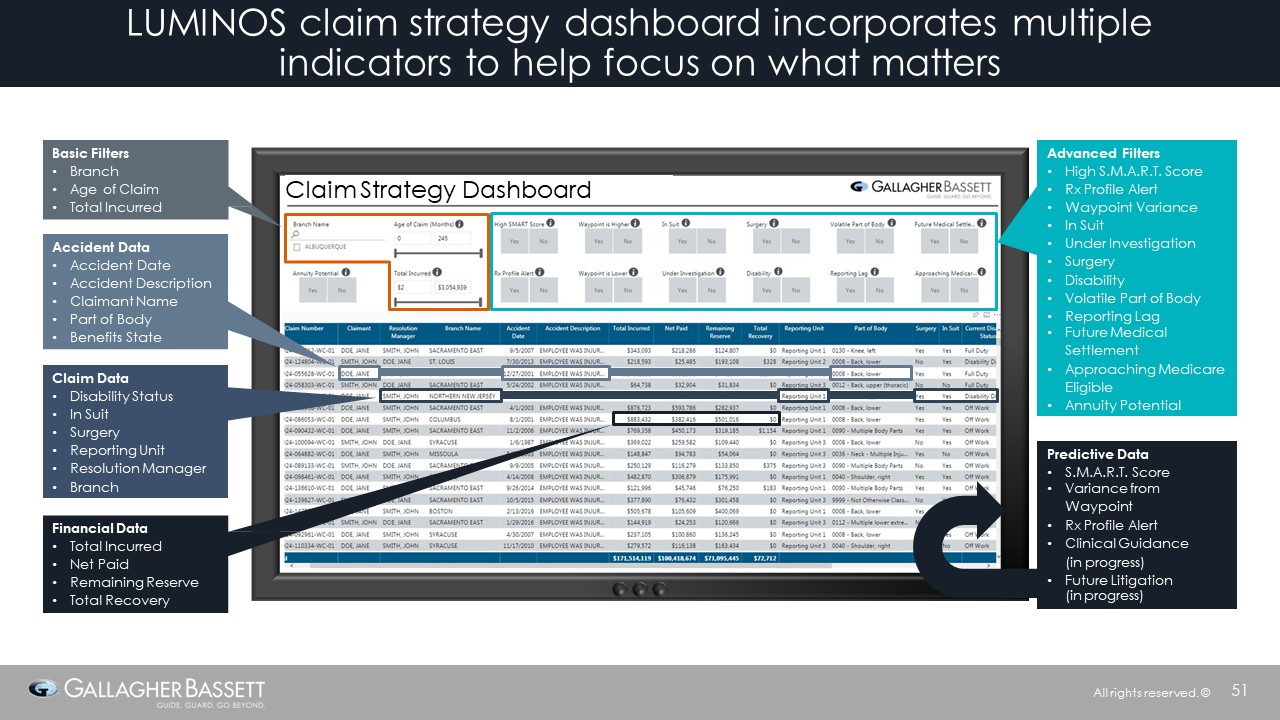

GB's innovation includes data-rich tools to target cost driver claims and identify files with a propensity toward adverse development.The Claim Strategy Dashboard incorporates claim elements with advanced filters and predictive data to help focus on what matters. GB helps identify objectives that will provide the most favorable impact to our client's total cost of risk (TCOR) by utilizing this dashboard along with other dynamic tools such as our interactive KPI Dashboard. This dashboard provides ongoing line of sight to performance, along with our annual Stewardship.

By utilizing tools in this way, GB client service managers have been able to isolate narrower, more targeted sets of claims from which to have a thematic conversation during each claim review. If the objective of the review is to ensure reserve accuracy before the next actuarial analysis, instead of discussing all claims above a certain dollar threshold (e.g., $20,000), they may only select claims with high complexity scores, low incurred values, and large variances to reserve predictive models. Applying a targeted approach like this allows participants to home in on vital claims and eliminate redundant conversations around less critical ones. In addition to the reduction in volume of claims discussed, the following benefits may be expected from placing a greater strategic emphasis around claim reviews:

- Increased insight for clients on program performance (through data analysis in partnership with their client services manager and broker)

- Efficiencies gained for all parties, in turn, enabling optimization of time toward effective adjudication of claims

- Improved claim outcomes (lower duration, higher closure ratio, decrease in lost workdays, etc.)

- Reduced TCOR

Example 1: Revamping Claim Reviews To Focus On Complexity And Return To Work

A large, national healthcare provider teamed up with GB to narrow the focus of their claim reviews by exclusively reviewing high complexity claims and homing in on strategies to return employees to work as quickly as possible. Rather than setting an arbitrary incurred threshold, this client used GB's Claim Strategy Dashboard to identify high complexity claims and implement more in-depth quarterly strategy discussions to bring these files to resolution. Taking this approach, the client was able to reduce the number of claims reviewed each quarter by half (from ~120 to 55) and achieve better outcomes in the process. Since the first strategic claim review in October 2020, they have thus far closed over 40% of all open claims reviewed.

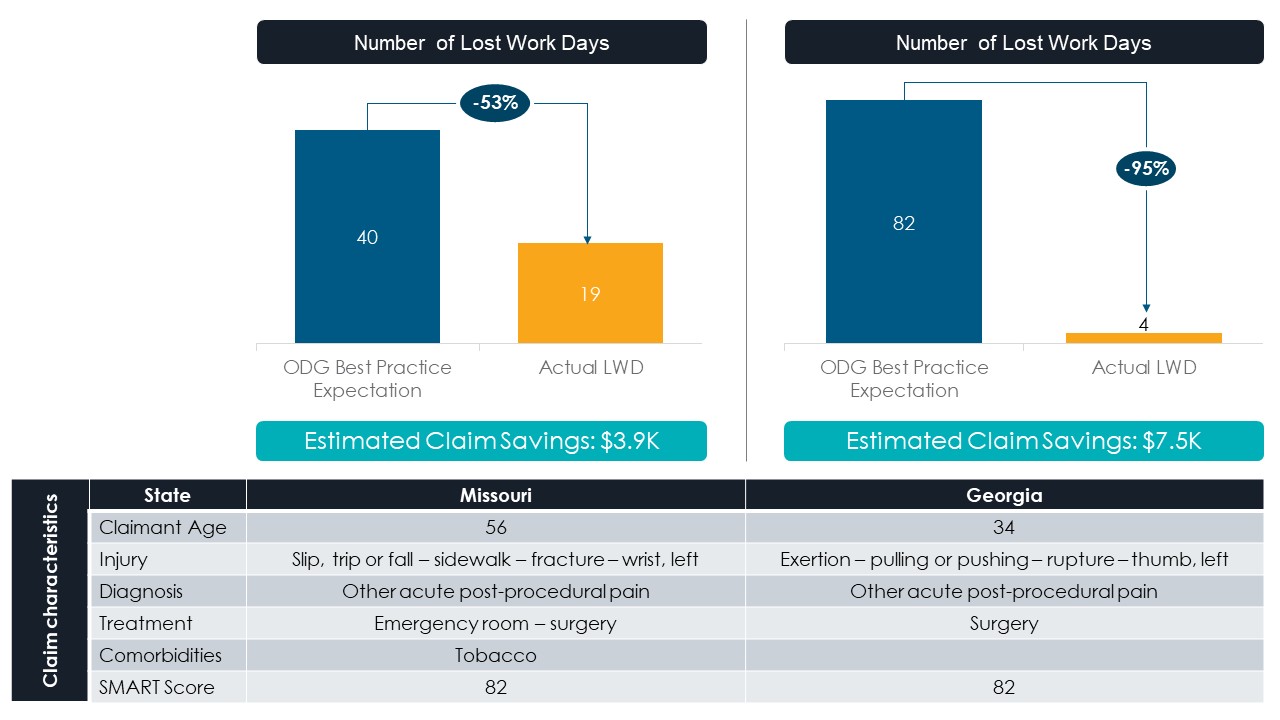

Among closed claims with Temporary Total Disability payments and disability days, more than 70% had fewer lost workdays than Official Disability Guideline's (ODG's) Best Practice prediction. Below are specific examples of some high complexity claims that closed well below ODG's expected number of lost workdays and the implied savings for each:

Example 2: Thematic Claim Reviews To Achieve Strategic Goals

For the last two years, a large furniture manufacturer and GB have selected quarterly claim review themes based upon stewardship results. The criteria selected include indicators such as litigation, high complexity, duration of the claim, and repetitive trauma. Not only has this narrowed focus resulted in an 80% reduction in claims reviewed and time savings for the GB resolution managers but it has also been a significant efficiency gain for the risk manager, who stated that by "using this structure, I no longer have to block two days and have many people from our organization at the review. This design has given me back three full days of work time."

As a result of each review, action items were created to drive each set of claims to resolution, generating the tremendous outcomes outlined below:

With the evolving landscape of claims management through innovation and predictive modeling, now is the time to use these gained insights for data-driven file selections for claim reviews. As evidenced through the application of aligning claim selection with identified objectives and goals, efficiencies will be improved for all participants, and better outcomes will be achieved for clients.

If you need a partner that will help you overcome your biggest challenges and make strategic moves toward the future, Gallagher Bassett is here. We focus on outcomes and aim for the best possible result for you and your business. We can help you deliver on your promises to your customers, just like we've been doing for ours over the last 50 years. Get in touch today to learn how we can help your organization drive transformation.

Make Gallagher Bassett your dependable partner

When making the right decision at the right time is critical to minimize risk for your business, count on Gallagher Bassett's extensive experience and global network to deliver.